cathernhirth70

About cathernhirth70

Exploring Personal Loans for Bad Credit: An Observational Study On Online Options

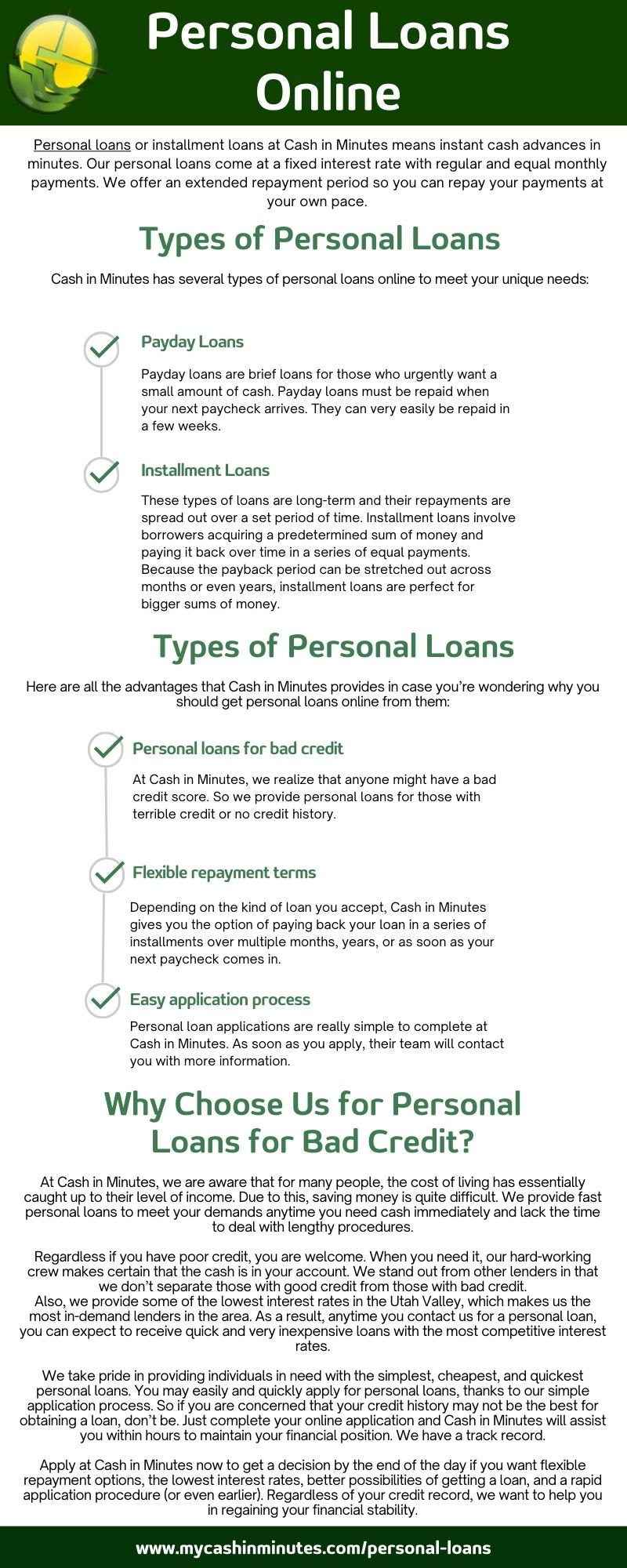

In today’s monetary panorama, personal loans have emerged as a vital resource for people searching for to handle rapid monetary needs. However, for those with dangerous credit score, accessing these loans may be notably difficult. This observational research article delves into the dynamics of personal loans for bad credit obtainable on-line, analyzing the developments, options, and implications for borrowers.

Understanding Dangerous Credit

Dangerous credit score is mostly outlined as a credit score score under 580, which might end result from varied factors, including missed payments, excessive credit score utilization, or bankruptcy. People with dangerous credit score typically face increased curiosity charges and restricted loan options, making it troublesome to safe funding for emergencies, debt consolidation, or major purchases. In recent years, the rise of on-line lending platforms has supplied a possible resolution for these struggling with poor credit score histories.

The Rise of On-line Lending

The digital age has essentially reworked the lending landscape. Traditional banks and credit unions have historically been the primary sources of personal loans, however many individuals with bad credit discover themselves excluded from these avenues. Online lenders have stepped in to fill this gap, providing a spread of merchandise tailor-made to borrowers with less-than-splendid credit score. The convenience of making use of for loans on-line has made it easier for people to seek monetary help with out the stigma usually associated with dangerous credit score.

Varieties of Online Personal Loans for Bad Credit

- Peer-to-Peer Lending: Platforms like LendingClub and Prosper connect borrowers with individual investors keen to fund their loans. These platforms often consider elements beyond credit score scores, comparable to income and employment historical past, making them a viable choice for those with unhealthy credit.

- Secured Loans: Some on-line lenders supply secured personal loans, which require borrowers to supply collateral, such as a car or financial savings account. This reduces the lender’s threat and may end up in lower interest charges for borrowers, even these with bad credit score.

- Payday Loans: While not sometimes recommended on account of their exorbitant curiosity charges and short repayment terms, payday loans are another option accessible on-line. Borrowers can receive fast money, but they have to be cautious of the potential for falling into a cycle of debt.

- Credit Union Loans: Many credit unions supply personal loans to their members, including these with bad credit score. Online functions have made it simpler to access these loans, usually with extra favorable terms than conventional banks.

The appliance Course of

Applying for a personal loan online usually entails filling out a straightforward software type that requires personal info, earnings particulars, and credit historical past. Lenders usually perform a tender credit examine to evaluate eligibility without impacting the borrower’s credit score. This process is mostly faster than conventional lending, with many online lenders providing instant decisions.

Interest Rates and Charges

One of many most vital concerns for borrowers with dangerous credit score is the price of borrowing. Interest charges for personal loans can differ extensively based on the lender and the borrower’s credit profile. Whereas some on-line lenders could offer rates as little as 6%, these with unhealthy credit score might face charges exceeding 30%. Moreover, borrowers ought to be aware of potential charges, similar to origination fees or late payment penalties, which can add to the general value of the loan.

The Impact of Dangerous Credit on Loan Approval

Despite the availability of online choices, having bad credit still poses challenges for borrowers. Lenders may impose stricter criteria, including larger debt-to-revenue ratios or proof of stable income, to mitigate threat. When you liked this article along with you would like to receive more info about find a personal loan for bad credit kindly go to the web-page. Because of this, individuals with bad credit score might have to consider their monetary situation carefully earlier than making use of for a loan.

Options to Personal Loans

For individuals who could wrestle to safe a personal loan attributable to dangerous credit, a number of options exist:

- Credit score Counseling: Looking for recommendation from credit counseling services may also help individuals handle their debts and enhance their credit score scores over time.

- Debt Consolidation: Combining a number of debts right into a single loan with a lower curiosity charge will be an effective strategy for managing finances.

- Household and Buddies: Borrowing from family or friends can provide a extra flexible and interest-free option, although it might include its personal set of challenges.

The Position of Monetary Education

Because the demand for personal loans for bad credit continues to develop, so does the need for financial training. Borrowers should be knowledgeable about their choices, the implications of taking on debt, and the significance of bettering their credit score scores. Online sources, workshops, and community packages can play a vital role in equipping people with the information needed to make informed financial decisions.

Conclusion

Personal loans for bad credit obtainable on-line have revolutionized the best way individuals with poor credit score histories can entry funding. Whereas these loans present alternatives for financial relief, in addition they include dangers and prices that borrowers must navigate rigorously. By understanding the kinds of loans available, the appliance course of, and the implications of borrowing, people can make more knowledgeable decisions that align with their monetary targets. In the end, fostering monetary literacy and exploring alternatives can empower those with bad credit score to take cost of their financial futures.

No listing found.