clairlesouef31

About clairlesouef31

Understanding Personal Loans: A Comprehensive Take a Look At No Credit Check Options

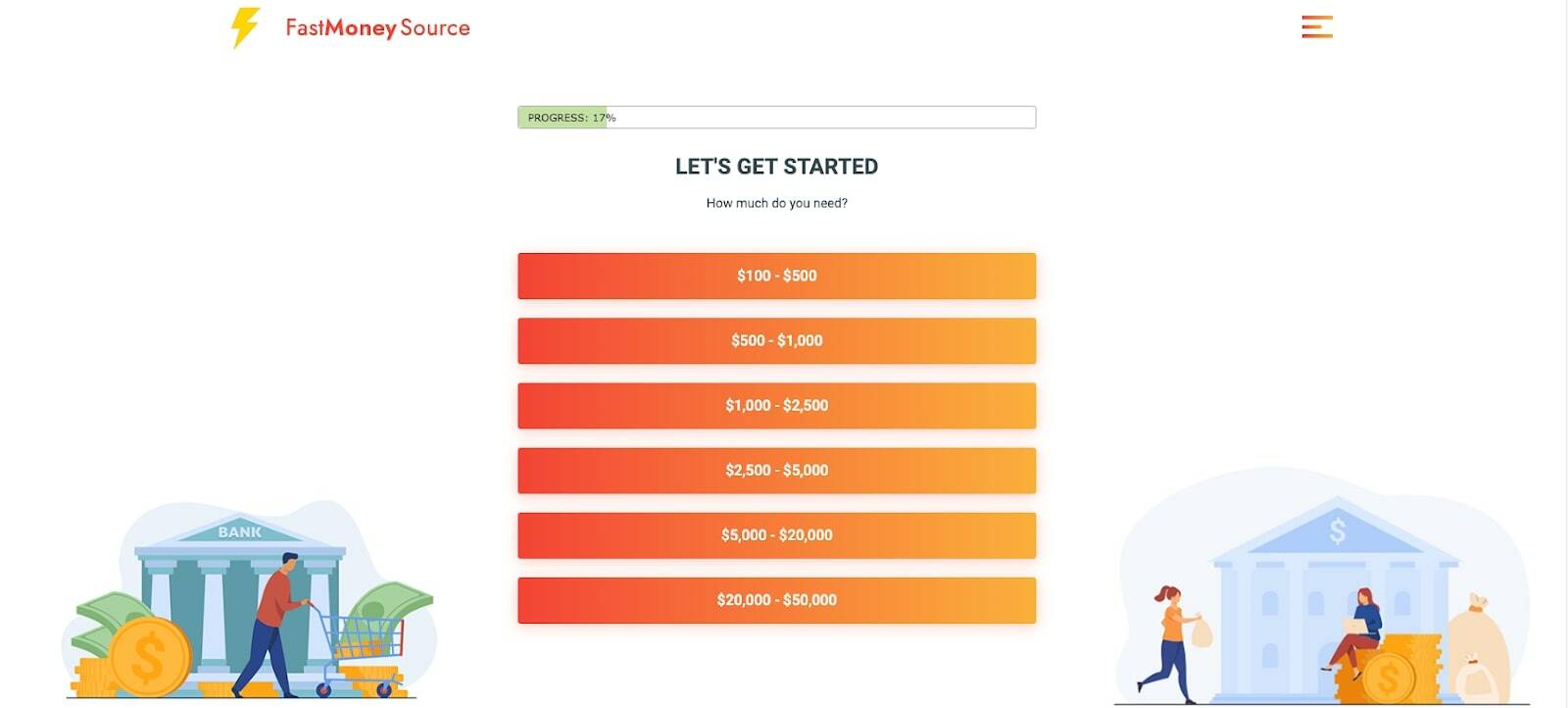

In right now’s monetary landscape, personal loans have emerged as a well-liked solution for people seeking quick entry to funds. Among various kinds of personal loans, these that offer no credit check have gained vital attention. This text delves into the nuances of personal loans without credit checks, exploring their attraction, advantages, potential pitfalls, and the general market landscape.

The Appeal of No Credit Check Personal Loans

One in every of the first reasons individuals gravitate in the direction of no credit check personal loans is the accessibility they provide. Conventional lenders usually rely heavily on credit scores to determine the eligibility of a borrower. For people with poor credit histories, this may be a significant barrier to obtaining crucial funds. No credit check loans present an alternate for those who may have faced financial difficulties up to now, allowing them to safe financing without the fear of rejection primarily based on their credit scores.

Additionally, the pace at which these loans will be processed is one other enticing feature. Many lenders offering no credit check options can provide funds within a matter of hours or days, making them excellent for emergencies comparable to medical bills, automotive repairs, or unexpected payments. This immediacy is an important factor for borrowers who need quick entry to money.

Forms of No Credit Check Personal Loans

No credit check personal loans are available in numerous types, catering to totally different monetary needs. The commonest varieties include:

- Payday Loans: These short-time period loans are designed to cowl expenses till the borrower receives their next paycheck. While they’re straightforward to acquire, they typically include exorbitant interest rates and charges.

- Title Loans: Borrowers can safe a loan through the use of their automobile as collateral. This feature allows people to access bigger sums of money however carries the danger of losing their automobile if they fail to repay the loan.

- Peer-to-Peer Lending: Some platforms connect borrowers with particular person traders keen to fund their loans with out traditional credit score checks. This method can offer more favorable phrases than payday or title loans.

- Installment Loans: These loans allow borrowers to repay the borrowed quantity in installments over a set interval. If you have any thoughts about where and how to use low income loans no credit checks, you can contact us at our own website. Whereas some lenders could not carry out credit checks, they could nonetheless assess the borrower’s earnings and potential to repay.

Benefits of No Credit Check Personal Loans

Whereas no credit check personal loans may be beneficial, they also come with distinct benefits:

- Accessibility: As talked about earlier, these loans are accessible to people with poor credit score histories, providing them with a financial lifeline when needed.

- Fast Approval: The streamlined utility process typically results in quick approvals, making them suitable for pressing monetary needs.

- Flexible Use: Borrowers can use the funds for numerous purposes, from consolidating debt to overlaying unexpected expenses.

- Less Traumatic Utility Course of: The absence of credit score checks can alleviate the stress associated with conventional loan functions, making the method more straightforward for borrowers.

Potential Pitfalls

Regardless of their benefits, no credit check personal loans include dangers that borrowers should be aware of:

- Excessive Interest Charges: Many no credit check loans, notably payday loans, include high-interest charges that may lead to a cycle of debt if not managed properly.

- Short Repayment Phrases: The repayment durations for these loans are often short, which may be difficult for borrowers who might struggle to repay the loan in time.

- Risk of Predatory Lending: The lack of credit checks can attract predatory lenders who exploit vulnerable borrowers. It’s crucial for people to analysis and choose reputable lenders.

- Affect on Monetary Well being: Relying on excessive-curiosity loans can negatively impression a borrower’s financial well being in the long term, leading to increased debt and financial instability.

The Market Panorama

The market for no credit check personal loans has developed over the years. With the rise of on-line lending platforms, borrowers now have extra choices than ever earlier than. These platforms typically present a extra clear lending course of, allowing borrowers to match charges and phrases easily.

Nevertheless, the proliferation of those loans has also raised concerns among shopper advocates. The potential for predatory lending practices has led to calls for larger regulation in the business. Varied states have carried out laws to protect consumers from exorbitant curiosity rates and unfair lending practices, but the effectiveness of those regulations varies significantly.

Suggestions for Borrowers

For individuals contemplating a no credit check personal loan, a number of ideas will help ensure a positive borrowing expertise:

- Analysis Lenders: Take the time to research numerous lenders and browse opinions. Search for these with a solid status and transparent terms.

- Understand the Phrases: Before committing to a loan, totally read the terms and conditions. Listen to interest charges, charges, and repayment schedules.

- Consider Alternatives: Explore different financing choices, such as credit score unions or group banks, which may provide extra favorable phrases even if they do check credit score.

- Borrow Responsibly: Solely borrow what you may afford to repay, and keep away from taking on multiple loans simultaneously.

- Plan for Repayment: Develop a transparent plan for repaying the loan to avoid falling right into a cycle of debt.

Conclusion

No credit check personal loans generally is a double-edged sword. While they provide essential access to funds for individuals with poor credit score histories, additionally they come with vital risks and potential pitfalls. By understanding the advantages and disadvantages associated with these loans, borrowers could make knowledgeable choices that align with their financial targets. Ultimately, accountable borrowing and thorough research are key to navigating the landscape of personal loans with out credit checks effectively.

No listing found.