landonohue0731

About landonohue0731

Investing in Gold And Silver IRAs: A Rising Development Amongst Savvy Traders

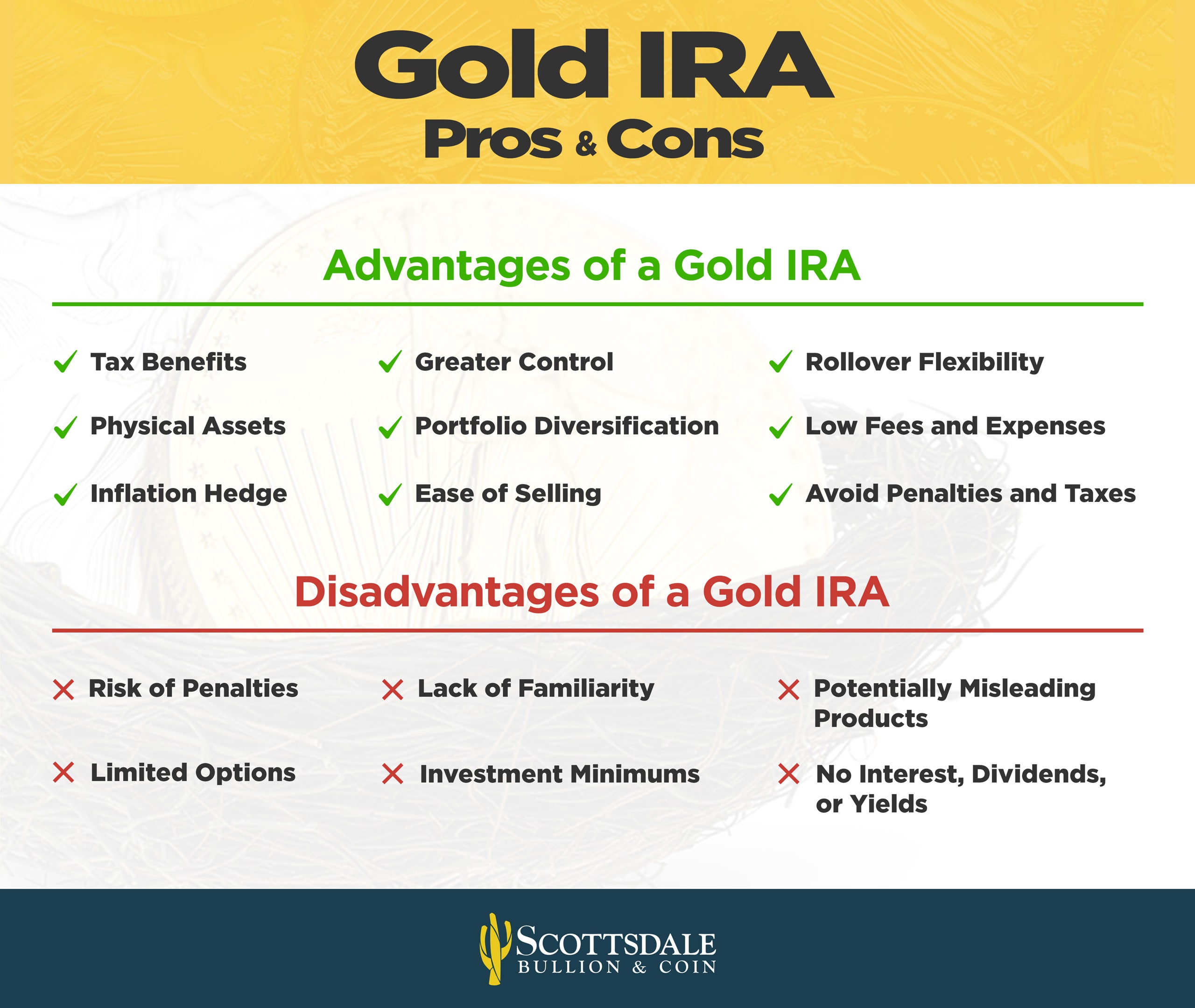

Lately, the financial landscape has seen a big shift as investors more and more turn to alternative belongings to safe their retirement financial savings. Amongst these options, gold and silver Particular person Retirement Accounts (IRAs) have gained reputation, providing a hedge against inflation and financial uncertainty. This article explores the rise of gold and silver IRA companies, their advantages, and what investors ought to consider when venturing into this niche market.

Gold and silver have long been thought-about safe-haven assets, particularly during occasions of economic turmoil. With the stock market’s volatility and the erosion of purchasing power as a consequence of inflation, many investors are searching for ways to diversify their portfolios. Gold and silver IRAs provide a possibility to invest in bodily treasured metals while having fun with the tax benefits associated with traditional retirement accounts.

The concept of a gold or silver IRA is relatively simple. These accounts enable buyers to hold bodily bullion, coins, or other approved valuable metal products within a tax-advantaged retirement account. This setup is governed by the interior Revenue Service (IRS), which has specific regulations regarding the types of metals that may be included and their respective purity ranges. For gold, the IRS mandates a minimum purity of 99.5%, whereas silver have to be at the least 99.9% pure.

As the demand for gold and silver IRAs has surged, quite a few companies have emerged to cater to this rising market. These firms focus on facilitating the setup and management of precious metal IRAs, guiding buyers through the process of selecting the correct products, and guaranteeing compliance with IRS regulations. Among the outstanding gold and silver IRA companies embrace Regal Belongings, Augusta Treasured Metals, and Birch Gold Group, every offering unique providers and options to attract potential shoppers.

One of the important thing benefits of investing in gold and silver IRAs is the potential for wealth preservation. Treasured metals have historically retained their worth over time, making them a beautiful option for individuals involved concerning the lengthy-time period stability of conventional belongings. Throughout intervals of financial downturn, gold and silver often carry out properly, providing a buffer towards losses incurred in other investment vehicles. This characteristic has made them significantly appealing to retirees and those nearing retirement, as they search to safeguard their laborious-earned financial savings.

Furthermore, gold and silver IRAs supply buyers a degree of control over their retirement belongings. In contrast to traditional IRAs, which sometimes spend money on stocks, bonds, and mutual funds, treasured steel IRAs allow individuals to straight personal bodily property. This tangible possession can provide peace of mind for investors who want to have a direct stake of their retirement financial savings. Moreover, these accounts can be self-directed, enabling investors to make decisions concerning their holdings with out relying on a monetary advisor.

However, investing in gold and silver IRAs is not without its challenges. One of the first issues is the price associated with buying and storing physical metals. Investors should be aware of the premiums charged over the spot value of gold and silver, in addition to any fees associated to account setup, maintenance, and storage. Many gold and silver IRA companies provide safe storage options through third-social gathering custodians, but these companies come at a further cost. It is important for buyers to thoroughly analysis and compare the fees and companies of various corporations before making a decision.

One other consideration is the potential for market volatility. While gold and silver have historically been seen as stable investments, their prices can fluctuate based mostly on various elements, including geopolitical events, adjustments in curiosity charges, and shifts in provide and demand. Buyers should be prepared for the potential of value swings and consider how these fluctuations might impression their overall retirement technique.

Moreover, potential buyers ought to be cautious of scams and unscrupulous firms which will prey on inexperienced people seeking to put money into gold and silver IRAs. The IRS has strict laws regarding the dealing with of retirement accounts, and it’s crucial to work with reputable corporations which might be clear about their charges, companies, and the products they offer. Checking for customer reviews, trade scores, and certifications can assist traders identify reliable corporations.

The regulatory landscape surrounding gold and silver IRAs is one other issue to contemplate. The IRS has specific guidelines concerning the kinds of metals that can be included in these accounts, and traders should be certain that their chosen merchandise meet these standards. If you have any sort of questions concerning where and the best ways to make use of navigate to this web-site, you could contact us at our web-site. Additionally, adjustments in tax laws or laws may impact the attractiveness of treasured steel IRAs in the future. Staying informed about these developments is essential for traders seeking to make knowledgeable decisions.

As the pattern of investing in gold and silver IRAs continues to develop, it is clear that these various belongings play a major function in the diversification methods of many traders. With a deal with wealth preservation and tangible ownership, gold and silver IRAs provide a unique alternative for individuals to secure their financial futures. Nonetheless, as with any funding, it is crucial to conduct thorough research, understand the related risks, and work with reputable firms to make sure a successful funding expertise.

In conclusion, gold and silver IRA companies are carving out a distinct segment within the retirement planning landscape, appealing to these seeking stability and safety in unsure times. Because the economy continues to evolve, the allure of treasured metals as a retirement funding is likely to persist, making it a necessary consideration for people trying to safeguard their financial properly-being. Whether you are a seasoned investor or simply beginning to explore your choices, understanding the ins and outs of gold and silver IRAs can empower you to make informed decisions that align with your long-term monetary targets.

No listing found.